Okay here we go.

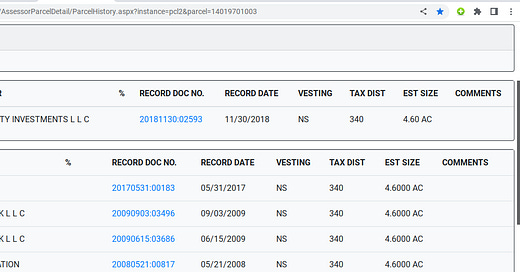

Assessor

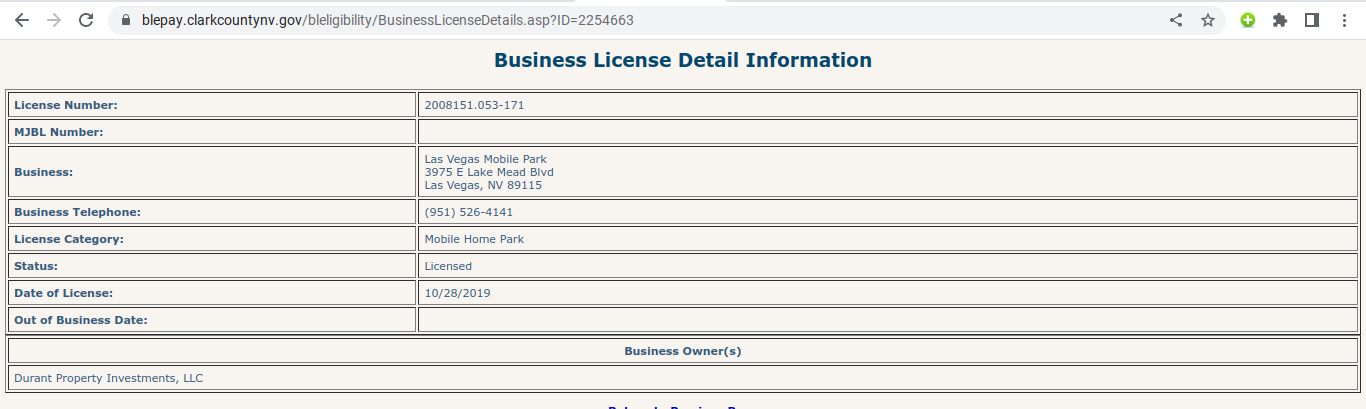

Business Lic

Doing Business in Clark County

From these screenshots and the following ones I came up with this list.

Owner of Record Per Assessor and License documents

CCA Clark County Assessor

BL Business License

BOS Bill of Sale Documents

01/07/64 Vegas Nebraska CCA

09/20/73 Dominic Damiani CCA

12/31/74 Sierra Association CCA

04/08/77 MarySue Cornwell CCA

01/28/88 Queen City Investments CCA

01/28/88 Ruby and Edmond Davis CCA

12/08/92 - 05/29/98 Ruby and Edmond Davis BL

05/29/98 Howard Henkin CCA

05/05/99 - 06/13/02 Howard Henkin BL

03/27/02 DSD CCA

03/25/02 Henkin and Knapp BOS

03/27/02 HH & SK CCA

03/25/02 Henkin to DSD BOS

04/29/03 - 05/22/08 Trailer Vegas BL

05/21/08 SR Financial CCA

05/16/08 DSD - SR Financial BOS

05/21/09 - 06/01/09 LVMP BL

09/23/09 - 06/01/17 LVMP BL

06/15/09 LVMP CCA

06/03/09 SR to LVMP BOS (Audit)

09/03/09 LVMP CCA

08/19/09 LVMP - LVMP BOS

10/27/99 - 07/27/10 James White Handyman BL

10/27/99 - 07/27/10 Thomas Filkin Handyman BL

12/28/17 - 03/20/19 LVMP BL

03/31/17 Casino Center LLC CCA

03/01/17 - 05/26/17 Hirmiz to Kris Kakkar BOS (How can it be filed properly if one of the signatures wasn’t till May

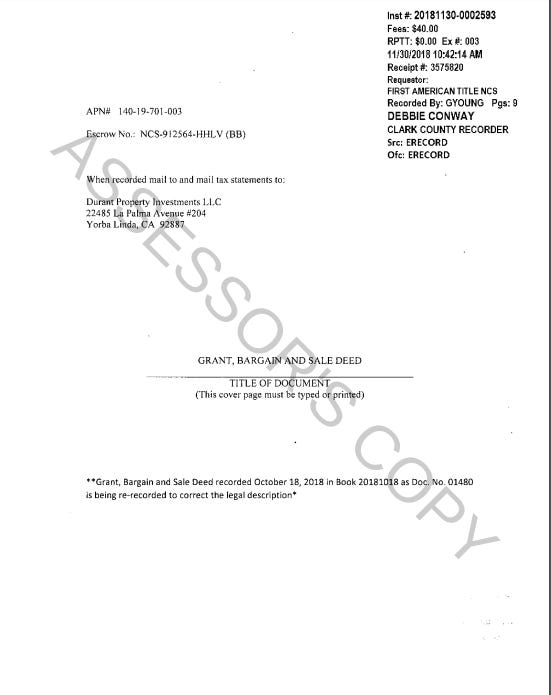

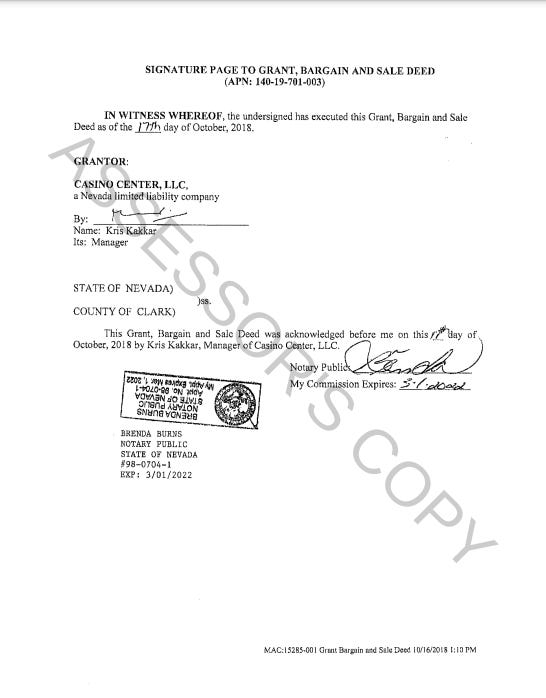

11/30/18 - Pres LVMP/Durant CCA

10/17/18 - 10/18/18 Kris Kakkar- LVMP BOS

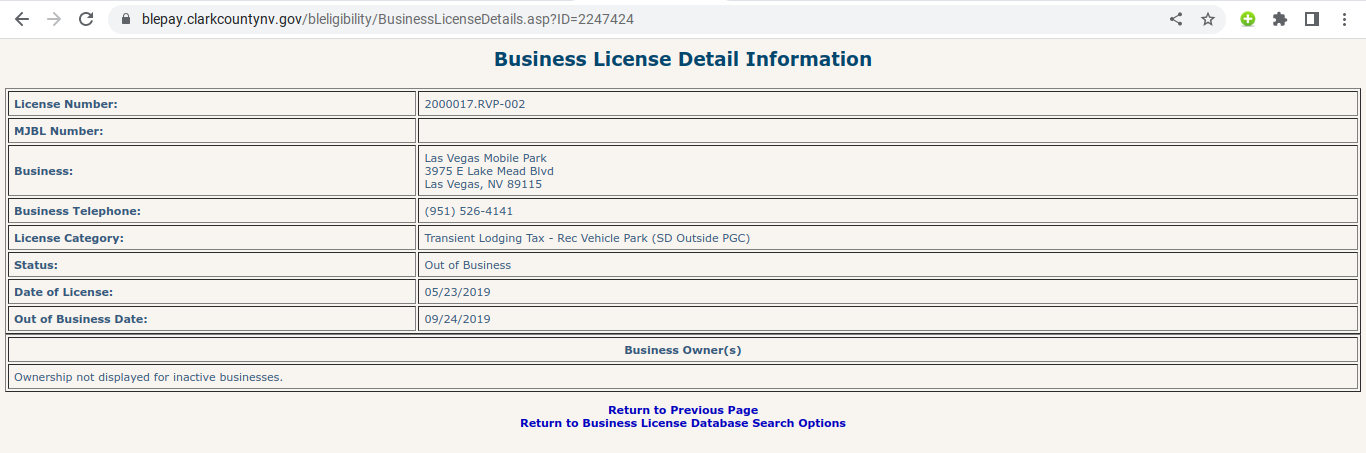

05/23/19 - 09/24/19 LVMP BL

05/23/19 - 09/24/19 LVMP BL

10/28/19 - PRES LVMP BL

Past business Licenses for Clark County

Current business license for Clark County

Now to break down each one with any permits IF they pulled any. Let us start with the current owner, Durant Investment Properties.

11/30/18 - Pres LVMP/Durant CCA

10/17/18 - 10/18/18 Kris Kakkar- LVMP BOS

05/23/19 - 09/24/19 LVMP BL

05/23/19 - 09/24/19 LVMP BL

10/28/19 - PRES LVMP BL

Sale Paperwork

How can you sell a property for $10.00?

I thought the property was sold for $10.00 how come on this page it states that it was sold for $1,683,000.00? Why is it that this property is now listed as Commercial/Industrial and not mobile home? Could it be that they are fixing to change it over to apartments like they said they were going to do?

How is this even legal when it only has 1 signature on it?

Current Business License

Previous Business License for the time period the Mr. Modi supposedly owned the property. There is no Business License for over a year after Mr. Modi offically bought the park and then he tried to get away with licensing it under an RV park and not a mobile home park to get it done cheaper because he got caught.

RV Park Licenses

On the Accela portal under Fire Prevention there are 2 permits for 2019. They do not have any dates other than 2019 so I can not really give you any good guess as to which license they are for but my best guess is they are for the RV park business license.

So there is not any documentation for the inspections in 2019 which there should be cough cough. You will see in a later post that the fire department requires a fire hydrant in the park to have a business license because Mr. Howard Henkin I believe (don’t quote me on this name I am doing it from memory) is told he has to have it up and running to get his business license. So all business licenses after they took the fire hydrant out of the park are ILLEGAL. According to the Fire Department codes you have to have a fire hydrant, or a major stock pile of water in order to have your license. The park that I am currently in is half the size of LVMP and they have 3 fire hydrants in this park. The first park we moved to when we got to Vegas had a bunch of meth cookers in the park and that year was SUPER dry. We had 2 RV’s catch fire that year before the electrical room caught fire. They didn’t have “fire hydrants” but they had a fire system that the fire hoses could attach to every 200 feet or so. Even with that it still scared me because RV’s are kindle for fires. As a retired fire chief/paramedic wife I have seen it all and know what fire can do. This is one of the things that when we get to a park I check out the safety issues before we sign our lease. I did not do this with LVMP because we moved there for my job. But I was also not too worried because we are preppers and had 750 gallons of water at the ready to protect our home.

Here are the first set of documents that will be filed. These have to be filed before before a class action can be filed.

Public Officer or Employee Information:

Entity Type: City

County

State

Public Entity

Public Office Title

Last Name

First Name

Street

City

State

Zip

Phone Work

Phone Other

Email

NRS Violations:

Mark which violations you are alleging were violated.

X NRS 281A.400(1) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

1. A public officer or employee shall not seek or accept any gift, service, favor, employment, engagement, emolument or economic opportunity, for the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity, which would tend improperly to influence a reasonable person in the public officer’s or employee’s position to depart from the faithful and impartial discharge of the public officer’s or employee’s public duties.

X NRS 281A.400(2) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

2. A public officer or employee shall not use the public officer’s or employee’s position in government to secure or grant unwarranted privileges, preferences, exemptions or advantages for the public officer or employee, any business entity in which the public officer or employee has a significant pecuniary interest or any person to whom the public officer or employee has a commitment in a private capacity. As used in this subsection, “unwarranted” means without justification or adequate reason.

NRS 281A.400(3) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

3. A public officer or employee shall not participate as an agent of government in the negotiation or execution of a contract between the government and the public officer or employee, any business entity in which the public officer or employee has a significant pecuniary interest or any person to whom the public officer or employee has a commitment in a private capacity.

X NRS 281A.400(4) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

4. A public officer or employee shall not accept any salary, retainer, augmentation, expense allowance or other compensation from any private source, for the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity, for the performance of the public officer’s or employee’s duties as a public officer or employee.

X NRS 281A.400(5) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

5. If a public officer or employee acquires, through the public officer’s or employee’s public duties or relationships, any information which by law or practice is not at the time available to people generally, the public officer or employee shall not use the information to further a significant pecuniary interest of the public officer or employee or any other person or business entity.

X NRS 281A.400(6) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

6. A public officer or employee shall not suppress any governmental report or other official document because it might tend to affect unfavorably a significant pecuniary interest of the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity.

X NRS 281A.400(7) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

7. Except for State Legislators who are subject to the restrictions set forth in subsection 8, a public officer or employee shall not use governmental time, property, equipment or other facility to benefit a significant personal or pecuniary interest of the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity. This subsection does not prohibit:

(a) A limited use of governmental property, equipment or other facility for personal purposes if:

(1) The public officer or employee who is responsible for and has authority to authorize the use of such property, equipment or other facility has established a policy allowing the use or the use is necessary as a result of emergency circumstances;

(2) The use does not interfere with the performance of the public officer’s or employee’s public duties;

(3) The cost or value related to the use is nominal; and

(4) The use does not create the appearance of impropriety;

(b) The use of mailing lists, computer data or other information lawfully obtained from a governmental agency which is available to members of the general public for nongovernmental purposes; or

(c) The use of telephones or other means of communication if there is not a special charge for that use.

Ê If a governmental agency incurs a cost as a result of a use that is authorized pursuant to this subsection or would ordinarily charge a member of the general public for the use, the public officer or employee shall promptly reimburse the cost or pay the charge to the governmental agency.

NRS 281A.400(8) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

8. A State Legislator shall not:

(a) Use governmental time, property, equipment or other facility for a nongovernmental purpose or for the private benefit of the State Legislator or any other person. This paragraph does not prohibit:

(1) A limited use of state property and resources for personal purposes if:

(I) The use does not interfere with the performance of the State Legislator’s public duties;

(II) The cost or value related to the use is nominal; and

(III) The use does not create the appearance of impropriety;

(2) The use of mailing lists, computer data or other information lawfully obtained from a governmental agency which is available to members of the general public for nongovernmental purposes; or

(3) The use of telephones or other means of communication if there is not a special charge for that use.

(b) Require or authorize a legislative employee, while on duty, to perform personal services or assist in a private activity, except:

(1) In unusual and infrequent situations where the employee’s service is reasonably necessary to permit the State Legislator or legislative employee to perform that person’s official duties; or

(2) Where such service has otherwise been established as legislative policy.

NRS 281A.400(9) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

9. A public officer or employee shall not attempt to benefit a significant personal or pecuniary interest of the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity through the influence of a subordinate.

NRS 281A.400(10) General requirements; exceptions. A code of ethical standards is hereby established to govern the conduct of public officers and employees:

10. A public officer or employee shall not seek other employment or contracts for the public officer or employee or any person to whom the public officer or employee has a commitment in a private capacity through the use of the public officer’s or employee’s official position.

NRS 281A.410 Limitations on representing or counseling private persons before public agencies; request for relief from strict application of certain provisions. In addition to the requirements of the code of ethical standards and the other provisions of this chapter:

1. If a public officer or employee serves in a state agency of the Executive Department or an agency of any county, city or other political subdivision, the public officer or employee:

(a) Shall not accept compensation from any private person to represent or counsel the private person on any issue pending before the agency in which that public officer or employee serves, if the agency makes decisions; and

(b) If the public officer or employee leaves the service of the agency, shall not, for 1 year after leaving the service of the agency, represent or counsel for compensation a private person upon any issue which was under consideration by the agency during the public officer’s or employee’s service. As used in this paragraph, “issue” includes a case, proceeding, application, contract or determination, but does not include the proposal or consideration of legislative measures or administrative regulations.

2. Except as otherwise provided in subsection 3, a State Legislator or a member of a local legislative body, or a public officer or employee whose public service requires less than half of his or her time, may represent or counsel a private person before an agency in which he or she does not serve.

3. A member of a local legislative body shall not represent or counsel a private person for compensation before another local agency if the territorial jurisdiction of the other local agency includes any part of the county in which the member serves. The Commission may relieve the member from the strict application of the provisions of this subsection if:

(a) The member files a request for an advisory opinion from the Commission pursuant to NRS 281A.675; and

(b) The Commission determines that such relief is not contrary to:

(1) The best interests of the public;

(2) The continued ethical integrity of each local agency affected by the matter; and

(3) The provisions of this chapter.

4. For the purposes of subsection 3, the request for an advisory opinion, the advisory opinion and all meetings, hearings and proceedings of the Commission in such a matter are governed by the provisions of NRS 281A.670 to 281A.690, inclusive.

5. Unless permitted by this section, a public officer or employee shall not represent or counsel a private person for compensation before any state agency of the Executive or Legislative Department.

NRS 281A.420(1) Requirements regarding disclosure of conflicts of interest and abstention from voting because of certain types of conflicts; effect of abstention on quorum and voting requirements; exceptions.

1. Except as otherwise provided in this section, a public officer or employee shall not approve, disapprove, vote, abstain from voting or otherwise act upon a matter:

(a) Regarding which the public officer or employee has accepted a gift or loan;

(b) In which the public officer or employee has a significant pecuniary interest;

(c) Which would reasonably be affected by the public officer’s or employee’s commitment in a private capacity to the interests of another person; or

(d) Which would reasonably be related to the nature of any representation or counseling that the public officer or employee provided to a private person for compensation before another agency within the immediately preceding year, provided such representation or counseling is permitted by NRS 281A.410,

Ê without disclosing information concerning the gift or loan, the significant pecuniary interest, the commitment in a private capacity to the interests of the other person or the nature of the representation or counseling of the private person that is sufficient to inform the public of the potential effect of the action or abstention upon the person who provided the gift or loan, upon the public officer’s or employee’s significant pecuniary interest, upon the person to whom the public officer or employee has a commitment in a private capacity or upon the private person who was represented or counseled by the public officer or employee. Such a disclosure must be made at the time the matter is considered. If the public officer or employee is a member of a body which makes decisions, the public officer or employee shall make the disclosure in public to the chair and other members of the body. If the public officer or employee is not a member of such a body and holds an appointive office, the public officer or employee shall make the disclosure to the supervisory head of the public officer’s or employee’s organization or, if the public officer holds an elective office, to the general public in the area from which the public officer is elected.

NRS 281A.420(3) Requirements regarding disclosure of conflicts of interest and abstention from voting because of certain types of conflicts; effect of abstention on quorum and voting requirements; exceptions.

3. Except as otherwise provided in this section, in addition to the requirements of subsection 1, a public officer shall not vote upon or advocate the passage or failure of, but may otherwise participate in the consideration of, a matter with respect to which the independence of judgment of a reasonable person in the public officer’s situation would be materially affected by:

(a) The public officer’s acceptance of a gift or loan;

(b) The public officer’s significant pecuniary interest; or

(c) The public officer’s commitment in a private capacity to the interests of another person.

NRS 281A.430 Contracts in which public officer or employee has interest prohibited; exceptions; request for relief from strict application of certain provisions.

1. Except as otherwise provided in this section and NRS 218A.970 and 332.800, a public officer or employee shall not bid on or enter into a contract between an agency and any business entity in which the public officer or employee has a significant pecuniary interest.

2. A member of any board, commission or similar body who is engaged in the profession, occupation or business regulated by such board, commission or body may, in the ordinary course of his or her business, bid on or enter into a contract with an agency, except the board, commission or body on which he or she is a member, if the member has not taken part in developing the contract plans or specifications and the member will not be personally involved in opening, considering or accepting offers.

3. A full- or part-time faculty member or employee of the Nevada System of Higher Education may bid on or enter into a contract with an agency, or may benefit financially or otherwise from a contract between an agency and a private entity, if the contract complies with the policies established by the Board of Regents of the University of Nevada pursuant to NRS 396.255.

4. Except as otherwise provided in subsection 2, 3 or 5, a public officer or employee may bid on or enter into a contract with an agency if:

(a) The contracting process is controlled by the rules of open competitive bidding or the rules of open competitive bidding or for a solicitation are not employed as a result of the applicability of NRS 332.112 or 332.148;

(b) The sources of supply are limited;

(c) The public officer or employee has not taken part in developing the contract plans or specifications; and

(d) The public officer or employee will not be personally involved in opening, considering or accepting offers.

Ê If a public officer who is authorized to bid on or enter into a contract with an agency pursuant to this subsection is a member of the governing body of the agency, the public officer, pursuant to the requirements of NRS 281A.420, shall disclose the public officer’s interest in the contract and shall not vote on or advocate the approval of the contract.

5. A member of a local legislative body shall not, either individually or through any business entity in which the member has a significant pecuniary interest, sell goods or services to the local agency governed by his or her local legislative body unless:

(a) The member, or the business entity in which the member has a significant pecuniary interest, offers the sole source of supply of the goods or services within the territorial jurisdiction of the local agency governed by his or her local legislative body;

(b) The local legislative body includes in the public notice and agenda for the meeting at which it will consider the purchase of such goods or services a clear and conspicuous statement that it is considering purchasing such goods or services from one of its members, or from a business entity in which the member has a significant pecuniary interest;

(c) At the meeting, the member discloses his or her significant pecuniary interest in the purchase of such goods or services and does not vote upon or advocate the approval of the matter pursuant to the requirements of NRS 281A.420; and

(d) The local legislative body approves the purchase of such goods or services in accordance with all other applicable provisions of law.

6. The Commission may relieve a public officer or employee from the strict application of the provisions of this section if:

(a) The public officer or employee files a request for an advisory opinion from the Commission pursuant to NRS 281A.675; and

(b) The Commission determines that such relief is not contrary to:

(1) The best interests of the public;

(2) The continued ethical integrity of each agency affected by the matter; and

(3) The provisions of this chapter.

7. For the purposes of subsection 6, the request for an advisory opinion, the advisory opinion and all meetings, hearings and proceedings of the Commission in such a matter are governed by the provisions of NRS 281A.670 to 281A.690, inclusive.

NRS 281A.500 Notice and acknowledgment of statutory ethical standards: Distribution of information regarding standards; duty to file acknowledgment; contents; form; retention; penalty for willful refusal to file.

1. On or before the date on which a public officer swears or affirms the oath of office, the public officer must be informed of the statutory ethical standards and the duty to file an acknowledgment of the statutory ethical standards in accordance with this section by:

(a) For an appointed public officer, the appointing authority of the public officer; and

(b) For an elected public officer of:

(1) The county and other political subdivisions within the county except cities, the county clerk;

(2) The city, the city clerk;

(3) The Legislative Department of the State Government, the Director of the Legislative Counsel Bureau; and

(4) The Executive Department of the State Government, the Director of the Department of Administration, or his or her designee.

2. Within 30 days after a public employee begins employment:

(a) The Director of the Department of Administration, or his or her designee, shall provide each new public employee of a state agency with the information prepared by the Commission concerning the statutory ethical standards; and

(b) The manager of each local agency, or his or her designee, shall provide each new public employee of the local agency with the information prepared by the Commission concerning the statutory ethical standards.

3. Each public officer shall acknowledge that the public officer:

(a) Has received, read and understands the statutory ethical standards; and

(b) Has a responsibility to inform himself or herself of any amendments to the statutory ethical standards as soon as reasonably practicable after each session of the Legislature.

4. The acknowledgment must be executed on a form prescribed by the Commission and must be filed with the Commission:

(a) If the public officer is elected to office at the general election, on or before January 15 of the year following the public officer’s election.

(b) If the public officer is elected to office at an election other than the general election or is appointed to office, on or before the 30th day following the date on which the public officer swears or affirms the oath of office.

5. Except as otherwise provided in this subsection, a public officer shall execute and file the acknowledgment once for each term of office. If the public officer serves at the pleasure of the appointing authority and does not have a definite term of office, the public officer, in addition to executing and filing the acknowledgment after the public officer swears or affirms the oath of office in accordance with subsection 4, shall execute and file the acknowledgment on or before January 15 of each even-numbered year while the public officer holds that office.

6. For the purposes of this section, the acknowledgment is timely filed if, on or before the last day for filing, the acknowledgment is filed in one of the following ways:

(a) Delivered in person to the principal office of the Commission in Carson City.

(b) Mailed to the Commission by first-class mail, or other class of mail that is at least as expeditious, postage prepaid. Filing by mail is complete upon timely depositing the acknowledgment with the United States Postal Service.

(c) Dispatched to a third-party commercial carrier for delivery to the Commission within 3 calendar days. Filing by third-party commercial carrier is complete upon timely depositing the acknowledgment with the third-party commercial carrier.

(d) Transmitted to the Commission by facsimile machine or other electronic means authorized by the Commission. Filing by facsimile machine or other electronic means is complete upon receipt of the transmission by the Commission.

7. If a public officer is serving in a public office and executes and files the acknowledgment for that office as required by the applicable provisions of this section, the public officer shall be deemed to have satisfied the requirements of this section for any other office held concurrently by him or her.

8. The form for making the acknowledgment must contain:

(a) The address of the Internet website of the Commission where a public officer may view the statutory ethical standards and print a copy of the standards; and

(b) The telephone number and mailing address of the Commission where a public officer may make a request to obtain a printed copy of the statutory ethical standards from the Commission.

9. Whenever the Commission, or any public officer or employee as part of the public officer’s or employee’s official duties, provides a public officer with a printed copy of the form for making the acknowledgment, a printed copy of the statutory ethical standards must be included with the form.

10. The Commission shall retain each acknowledgment filed pursuant to this section for 6 years after the date on which the acknowledgment was filed.

11. Willful refusal to execute and file the acknowledgment required by this section shall be deemed to be:

(a) A willful violation of this chapter for the purposes of NRS 281A.785 and 281A.790; and

(b) Nonfeasance in office for the purposes of NRS 283.440 and, if the public officer is removable from office pursuant to NRS 283.440, the Commission may file a complaint in the appropriate court for removal of the public officer pursuant to that section. This paragraph grants an exclusive right to the Commission, and no other person may file a complaint against the public officer pursuant to NRS 283.440 based on any violation of this section.

12. As used in this section, “general election” has the meaning ascribed to it in NRS 293.060.

NRS 281A.510 Public officer or employee prohibited from accepting or receiving honorarium; penalty.

1. A public officer or public employee shall not accept or receive an honorarium.

2. An honorarium paid on behalf of a public officer or public employee to a charitable organization from which the officer or employee does not derive any financial benefit is deemed not to be accepted or received by the officer or employee for the purposes of this section.

3. This section does not prohibit:

(a) The receipt of payment for work performed outside the normal course of a person’s public office or employment if the performance of that work is consistent with the applicable policies of the person’s public employer regarding supplemental employment.

(b) The receipt of an honorarium by the spouse of a public officer or public employee if it is related to the spouse’s profession or occupation.

4. As used in this section, “honorarium” means the payment of money or anything of value for an appearance or speech by the public officer or public employee in the officer’s or employee’s capacity as a public officer or public employee. The term does not include the payment of:

(a) The actual and necessary costs incurred by the public officer or public employee, the officer’s or employee’s spouse or the officer’s or employee’s aid for transportation and for lodging and meals while the public officer or public employee is away from the officer’s or employee’s residence.

(b) Compensation which would otherwise have been earned by the public officer or public employee in the normal course of the officer’s or employee’s public office or employment.

(c) A fee for a speech related to the officer’s or employee’s profession or occupation outside of the officer’s or employee’s public office or employment if:

(1) Other members of the profession or occupation are ordinarily compensated for such a speech; and

(2) The fee paid to the public officer or public employee is approximately the same as the fee that would be paid to a member of the private sector whose qualifications are similar to those of the officer or employee for a comparable speech.

(d) A fee for a speech delivered to an organization of legislatures, legislators or other elected officers.

5. In addition to any other penalties provided by law, a public officer or public employee who violates the provisions of this section shall forfeit the amount of the honorarium.

NRS 281A.520 Public officer or employee prohibited from requesting or otherwise causing governmental entity to incur expense or make expenditure to support or oppose ballot question or candidate in certain circumstances.

1. Except as otherwise provided in subsections 4 and 5, a public officer or employee shall not request or otherwise cause a governmental entity to incur an expense or make an expenditure to support or oppose:

(a) A ballot question.

(b) A candidate.

2. For the purposes of paragraph (b) of subsection 1, an expense incurred or an expenditure made by a governmental entity shall be considered an expense incurred or an expenditure made in support of a candidate if:

(a) The expense is incurred or the expenditure is made for the creation or dissemination of a pamphlet, brochure, publication, advertisement or television programming that prominently features the activities of a current public officer of the governmental entity who is a candidate for a state, local or federal elective office; and

(b) The pamphlet, brochure, publication, advertisement or television programming described in paragraph (a) is created or disseminated during the period specified in subsection 3.

3. The period during which the provisions of subsection 2 apply to a particular governmental entity begins when a current public officer of that governmental entity files a declaration of candidacy and ends on the date of the general election, general city election or special election for the office for which the current public officer of the governmental entity is a candidate.

4. The provisions of this section do not prohibit the creation or dissemination of, or the appearance of a candidate in or on, as applicable, a pamphlet, brochure, publication, advertisement or television programming that:

(a) Is made available to the public on a regular basis and merely describes the functions of:

(1) The public office held by the public officer who is the candidate; or

(2) The governmental entity by which the public officer who is the candidate is employed; or

(b) Is created or disseminated in the course of carrying out a duty of:

(1) The public officer who is the candidate; or

(2) The governmental entity by which the public officer who is the candidate is employed.

5. The provisions of this section do not prohibit an expense or an expenditure incurred to create or disseminate a television program that provides a forum for discussion or debate regarding a ballot question, if persons both in support of and in opposition to the ballot question participate in the television program.

6. As used in this section:

(a) “Governmental entity” means:

(1) The government of this State;

(2) An agency of the government of this State;

(3) A political subdivision of this State; and

(4) An agency of a political subdivision of this State.

(b) “Pamphlet, brochure, publication, advertisement or television programming” includes, without limitation, a publication, a public service announcement and any programming on a television station created to provide community access to cable television. The term does not include:

(1) A press release issued to the media by a governmental entity; or

(2) The official website of a governmental entity.

NRS 281A.550 Employment of certain former public officers and employees by regulated businesses prohibited; certain former public officers and employees prohibited from soliciting or accepting employment from certain persons contracting with State or local government; request for relief from strict application of certain provisions.

1. A former member of the Public Utilities Commission of Nevada shall not:

(a) Be employed by a public utility or parent organization or subsidiary of a public utility; or

(b) Appear before the Public Utilities Commission of Nevada to testify on behalf of a public utility or parent organization or subsidiary of a public utility,

Ê for 1 year after the termination of the member’s service on the Public Utilities Commission of Nevada.

2. A former member of the Nevada Gaming Control Board or the Nevada Gaming Commission shall not:

(a) Appear before the Nevada Gaming Control Board or the Nevada Gaming Commission on behalf of a person who holds a license issued pursuant to chapter 463 or 464 of NRS or who is required to register with the Nevada Gaming Commission pursuant to chapter 463 of NRS; or

(b) Be employed by such a person,

Ê for 1 year after the termination of the member’s service on the Nevada Gaming Control Board or the Nevada Gaming Commission.

3. In addition to the prohibitions set forth in subsections 1 and 2, and except as otherwise provided in subsections 4 and 6, a former public officer or employee of a board, commission, department, division or other agency of the Executive Department of State Government, except a clerical employee, shall not solicit or accept employment from a business or industry whose activities are governed by regulations adopted by the board, commission, department, division or other agency for 1 year after the termination of the former public officer’s or employee’s service or period of employment if:

(a) The former public officer’s or employee’s principal duties included the formulation of policy contained in the regulations governing the business or industry;

(b) During the immediately preceding year, the former public officer or employee directly performed activities, or controlled or influenced an audit, decision, investigation or other action, which significantly affected the business or industry which might, but for this section, employ the former public officer or employee; or

(c) As a result of the former public officer’s or employee’s governmental service or employment, the former public officer or employee possesses knowledge of the trade secrets of a direct business competitor.

4. The provisions of subsection 3 do not apply to a former public officer who was a member of a board, commission or similar body of the State if:

(a) The former public officer is engaged in the profession, occupation or business regulated by the board, commission or similar body;

(b) The former public officer holds a license issued by the board, commission or similar body; and

(c) Holding a license issued by the board, commission or similar body is a requirement for membership on the board, commission or similar body.

5. Except as otherwise provided in subsection 6, a former public officer or employee of the State or a political subdivision, except a clerical employee, shall not solicit or accept employment from a person to whom a contract for supplies, materials, equipment or services was awarded by the State or political subdivision, as applicable, for 1 year after the termination of the officer’s or employee’s service or period of employment, if:

(a) The amount of the contract exceeded $25,000;

(b) The contract was awarded within the 12-month period immediately preceding the termination of the officer’s or employee’s service or period of employment; and

(c) The position held by the former public officer or employee at the time the contract was awarded allowed the former public officer or employee to affect or influence the awarding of the contract.

6. A current or former public officer or employee may file a request for an advisory opinion pursuant to NRS 281A.675 concerning the application of the relevant facts in that person’s case to the provisions of subsection 3 or 5, as applicable, and determine whether relief from the strict application of those provisions is proper. If the Commission determines that relief from the strict application of the provisions of subsection 3 or 5, as applicable, is not contrary to:

(a) The best interests of the public;

(b) The continued ethical integrity of the State Government or political subdivision, as applicable; and

(c) The provisions of this chapter,

Ê it may issue an advisory opinion to that effect and grant such relief.

7. For the purposes of subsection 6, the request for an advisory opinion, the advisory opinion and all meetings, hearings and proceedings of the Commission in such a matter are governed by the provisions of NRS 281A.670 to 281A.690, inclusive.

8. The advisory opinion does not relieve the current or former public officer or employee from the strict application of any provision of NRS 281A.410.

9. For the purposes of this section:

(a) A former member of the Public Utilities Commission of Nevada, the Nevada Gaming Control Board or the Nevada Gaming Commission; or

(b) Any other former public officer or employee governed by this section,

Ê is employed by or is soliciting or accepting employment from a business, industry or other person described in this section if any oral or written agreement is sought, negotiated or exists during the restricted period pursuant to which the personal services of the public officer or employee are provided or will be provided to the business, industry or other person, even if such an agreement does not or will not become effective until after the restricted period.

10. As used in this section, “regulation” has the meaning ascribed to it in NRS 233B.038 and also includes regulations adopted by a board, commission, department, division or other agency of the Executive Department of State Government that is exempted from the requirements of chapter 233B of NRS.

NRS 281A.550 Employment of certain former public officers and employees by regulated businesses prohibited; certain former public officers and employees prohibited from soliciting or accepting employment from certain persons contracting with State or local government; request for relief from strict application of certain provisions.

1. A former member of the Public Utilities Commission of Nevada shall not:

(a) Be employed by a public utility or parent organization or subsidiary of a public utility; or

(b) Appear before the Public Utilities Commission of Nevada to testify on behalf of a public utility or parent organization or subsidiary of a public utility,

Ê for 1 year after the termination of the member’s service on the Public Utilities Commission of Nevada.

2. A former member of the Nevada Gaming Control Board or the Nevada Gaming Commission shall not:

(a) Appear before the Nevada Gaming Control Board or the Nevada Gaming Commission on behalf of a person who holds a license issued pursuant to chapter 463 or 464 of NRS or who is required to register with the Nevada Gaming Commission pursuant to chapter 463 of NRS; or

(b) Be employed by such a person,

Ê for 1 year after the termination of the member’s service on the Nevada Gaming Control Board or the Nevada Gaming Commission.

3. In addition to the prohibitions set forth in subsections 1 and 2, and except as otherwise provided in subsections 4 and 6, a former public officer or employee of a board, commission, department, division or other agency of the Executive Department of State Government, except a clerical employee, shall not solicit or accept employment from a business or industry whose activities are governed by regulations adopted by the board, commission, department, division or other agency for 1 year after the termination of the former public officer’s or employee’s service or period of employment if:

(a) The former public officer’s or employee’s principal duties included the formulation of policy contained in the regulations governing the business or industry;

(b) During the immediately preceding year, the former public officer or employee directly performed activities, or controlled or influenced an audit, decision, investigation or other action, which significantly affected the business or industry which might, but for this section, employ the former public officer or employee; or

(c) As a result of the former public officer’s or employee’s governmental service or employment, the former public officer or employee possesses knowledge of the trade secrets of a direct business competitor.

4. The provisions of subsection 3 do not apply to a former public officer who was a member of a board, commission or similar body of the State if:

(a) The former public officer is engaged in the profession, occupation or business regulated by the board, commission or similar body;

(b) The former public officer holds a license issued by the board, commission or similar body; and

(c) Holding a license issued by the board, commission or similar body is a requirement for membership on the board, commission or similar body.

5. Except as otherwise provided in subsection 6, a former public officer or employee of the State or a political subdivision, except a clerical employee, shall not solicit or accept employment from a person to whom a contract for supplies, materials, equipment or services was awarded by the State or political subdivision, as applicable, for 1 year after the termination of the officer’s or employee’s service or period of employment, if:

(a) The amount of the contract exceeded $25,000;

(b) The contract was awarded within the 12-month period immediately preceding the termination of the officer’s or employee’s service or period of employment; and

(c) The position held by the former public officer or employee at the time the contract was awarded allowed the former public officer or employee to affect or influence the awarding of the contract.

6. A current or former public officer or employee may file a request for an advisory opinion pursuant to NRS 281A.675 concerning the application of the relevant facts in that person’s case to the provisions of subsection 3 or 5, as applicable, and determine whether relief from the strict application of those provisions is proper. If the Commission determines that relief from the strict application of the provisions of subsection 3 or 5, as applicable, is not contrary to:

(a) The best interests of the public;

(b) The continued ethical integrity of the State Government or political subdivision, as applicable; and

(c) The provisions of this chapter,

Ê it may issue an advisory opinion to that effect and grant such relief.

7. For the purposes of subsection 6, the request for an advisory opinion, the advisory opinion and all meetings, hearings and proceedings of the Commission in such a matter are governed by the provisions of NRS 281A.670 to 281A.690, inclusive.

8. The advisory opinion does not relieve the current or former public officer or employee from the strict application of any provision of NRS 281A.410.

9. For the purposes of this section:

(a) A former member of the Public Utilities Commission of Nevada, the Nevada Gaming Control Board or the Nevada Gaming Commission; or

(b) Any other former public officer or employee governed by this section,

Ê is employed by or is soliciting or accepting employment from a business, industry or other person described in this section if any oral or written agreement is sought, negotiated or exists during the restricted period pursuant to which the personal services of the public officer or employee are provided or will be provided to the business, industry or other person, even if such an agreement does not or will not become effective until after the restricted period.

10. As used in this section, “regulation” has the meaning ascribed to it in NRS 233B.038 and also includes regulations adopted by a board, commission, department, division or other agency of the Executive Department of State Government that is exempted from the requirements of chapter 233B of NRS.

Pursuant to NRS 281A.065 “Commitment in a private capacity” defined. “Commitment in a private capacity,” with respect to the interests of another person, means a commitment, interest or relationship of a public officer or employee to a person:

1. Who is the spouse or domestic partner of the public officer or employee;

2. Who is a member of the household of the public officer or employee;

3. Who is related to the public officer or employee, or to the spouse or domestic partner of the public officer or employee, by blood, adoption, marriage or domestic partnership within the third degree of consanguinity or affinity;

4. Who employs the public officer or employee, the spouse or domestic partner of the public officer or employee or a member of the household of the public officer or employee;

5. With whom the public officer or employee has a substantial and continuing business relationship; or

6. With whom the public officer or employee has any other commitment, interest or relationship that is substantially similar to a commitment, interest or relationship described in subsections 1 to 5, inclusive.

Allegation Detail:

Describe in specific detail the public officer’s or employee’s conduct that you allege violated NRS Chapter 281A

(Include specific facts and circumstances to support your allegation: times, places, and the name and position of each person involved.)

Please see the PDF file BL CA

Pending Matters:

Is the alleged conduct currently pending before another administrative or judicial body? If yes describe:

No

Witnesses:

Witnesses: Identify persons who have knowledge of the facts and circumstances you have described, as well as the nature of the testimony, the person will provide.

Title/Entity Las Vegas Mobile Park

First Name Any and All Past and Current

Last Name Tenants

Street 3975 E. Lake Mead Blvd All Units

City Las Vegas

State NV

Zip 89115

Phone Home Varies

Phone Other (702) 886-9957

Email tenantadvocate89115@yahoo.com

Fax

Testimony/Notes Any tenant will tell you the deplorable conditions of this park. Please see the substack https://shininggodslight.substack.com this substack outlines all the atrocities going on in the park.

Evidence:

YOU MUST SUBMIT EVIDENCE TO SUPPORT YOUR ALLEGATIONS (NRS281A.710 through 281A.715)

Attach all documents of items you believe support your allegations, including witness statements, public or private records, audio or visual recordings, documents, exhibits, concrete objects, or other forms of proof.

ATTACH ALL EVIDENCE DOCUMENTS

When uploading attachments, please note that only the following file formats are accepted:

Document: .txt, .rd, .pdf, .doc, .docx, .ppt, .pptx, .pps, .ppsx, .odt, .xls, .xlsx

Images: .jpg, .jpeg, .png, .gif, .tif.

Video: .mp4, m4v, .wmv, .avi, .mpg

Audio: .mp3, .m4a, .ogg, .wav

PDF: BL CA

Business License 1

Your information:

Please note that when I go and turn these in I will fill out the million copies I need for each one with all the different names that go along with them. I am not taking the time right now to do this. I need to get as much of this stuff done before I get a huge box of documents dumped on me for my husbands case next week. Side note I dropped the hammer on an attorney in that case today. Unfortunately I could not be at the hearing in person due to one of my medical issues popping my hip out of place and I can not move. Just sitting up right now to work is killing me but I can not sit and do nothing for more than an hour before pulling my hair out. So I sit and work for an hour or so lay down for an hour or so. Meds are my best friend right now. Usually my husband will just see me limping and ask me if my hip or knee is out of joint. When this happened I was going from the sitting position to a kneeling position to get off my bed. As I got to the kneeling position my hip went out of joint and i fell flat out onto my bed. My husband was like are you okay your hip is not in place I can see it out. It is currently sitting 3 or 4 inches down my leg and it is rotated to the left 90 degrees. Last time it did this it took 4 days for it to go back into place on it’s own. No I can not go to the hospital well I can but they will just give me pain pills that don’t work and label me as a drug seeker. So I will stay with my natural medicine and pop it in myself. Prayers are appreciated.

Penalty

CCC 6.04.160 Covid NV Only 03/18/20 - 05/11/23 1149 days (set 1)

Code $1,000.00 a day

Billing $500.00 a day

1149 days X $500.00 = $574,500.00

CCC 6.04.110 Business License Violations (set 2)

Code $1,000.00 a day

Billing $500.00 a day

CCC 6.04.110 Any Violation (set 3)

1st Offense $250.00 - $1000.00 a day

Billing $500.00 a day

2nd Offense $500.00 - $1000.00 a day

Billing $750.00 a day

3rd Offense $750.00 - $1000.00 a day

Billing $875.00 a day

4th Offense $1,000.00 a day

Billing $950.00 a day

NRS 281A.790 State Ethics for Officials (set 4)

1st Willful Offense $5,000.00 a day

Billing $2,500.00 a day

2nd Willful Offense $10,000.00 a day

Billing $5,000.00 a day

3rd Willful Offense $25,000.00 a day

Billing $12,500.00 a day

Plus removal from office

Deemed malfeasance of Office

Business License 1 charges 11/30/18 to 06/01/23 (I put the date out until June 1st since I am going to be sending all of these in at one time. I am hoping I gave myself enough time to get all of these posts finished by then…. Just saying.) 15644 days Each day could be billed as a different offense according to the statute. But for the County, State, and Federal Officials I am just going to do the basic math. Example Business License 1 is going to be one offense, Business License 2 is going to be the second offense, etc. But when it comes to the owners or their heirs all bets are off.

Officials

Set 1 $574,500.00

Set 2 $7,822,000.00

Set 3 $9,777,500.00

Set 4 $39,110,000.00

Total $59,284,000.00

Mr. Modi

Set 1 $574,500.00

Set 2 $7,822,000.00

Set 3 $625.00

$750.00

$875.00

$950.00 x 15,641 = $14,858,950.00

Total$14,861,200.00

These are the totals that I will be seeking from all.